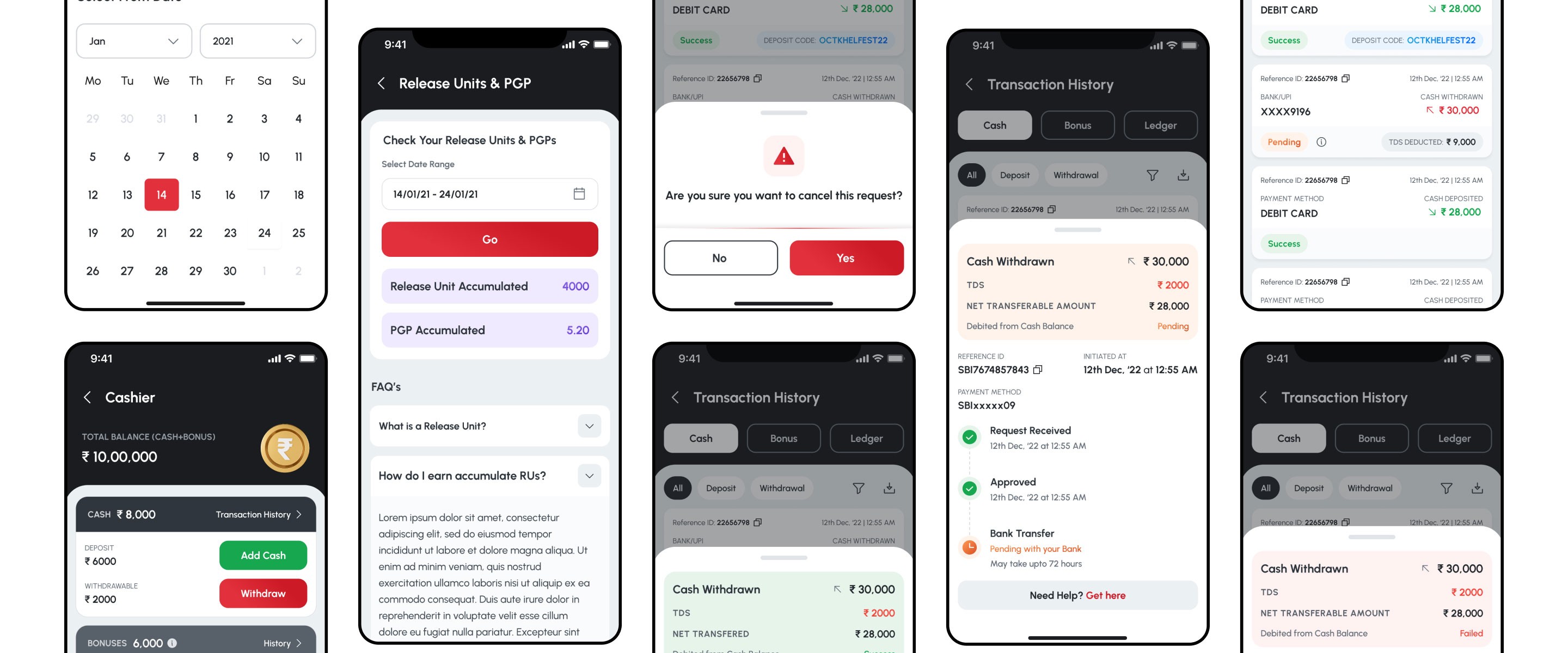

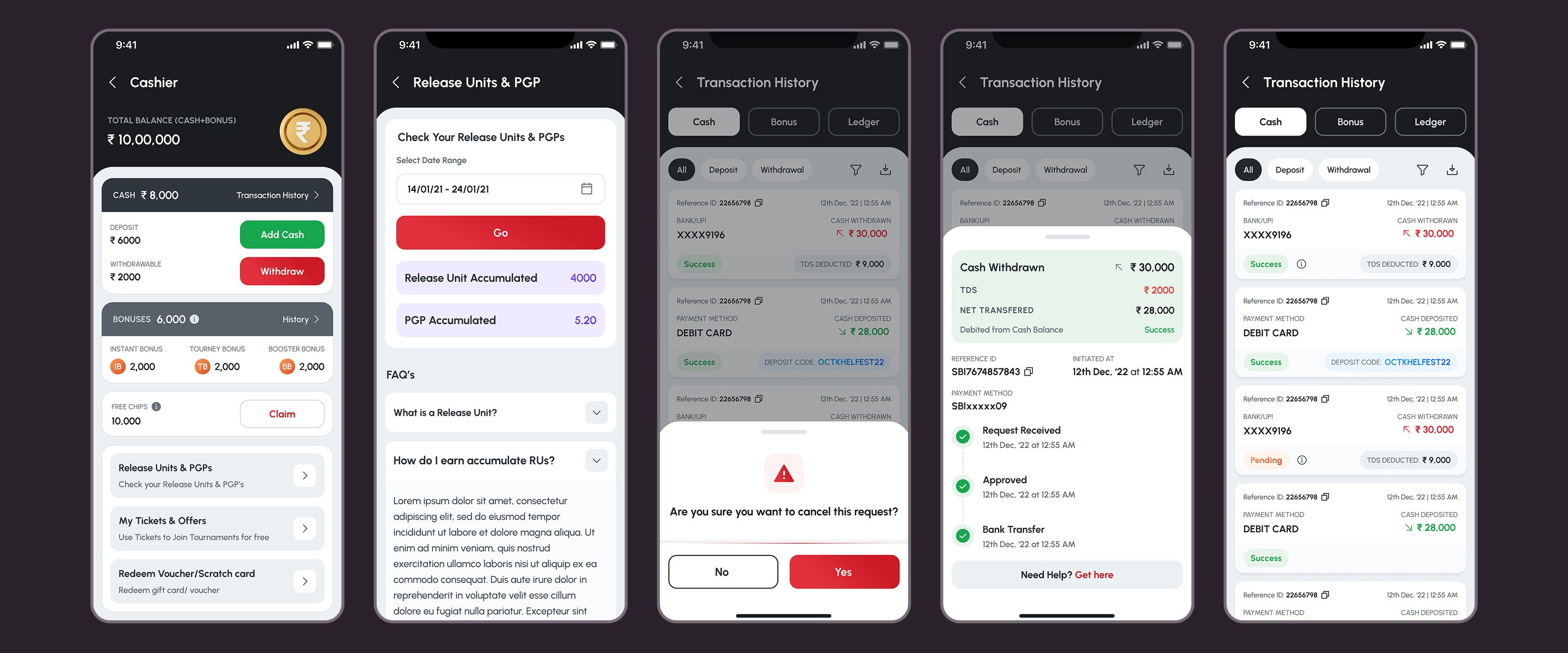

The wallet had three main issues:

Users were unsure what portions of payments were taxes, platform fees, or promotional credit, which caused hesitation during top-ups.

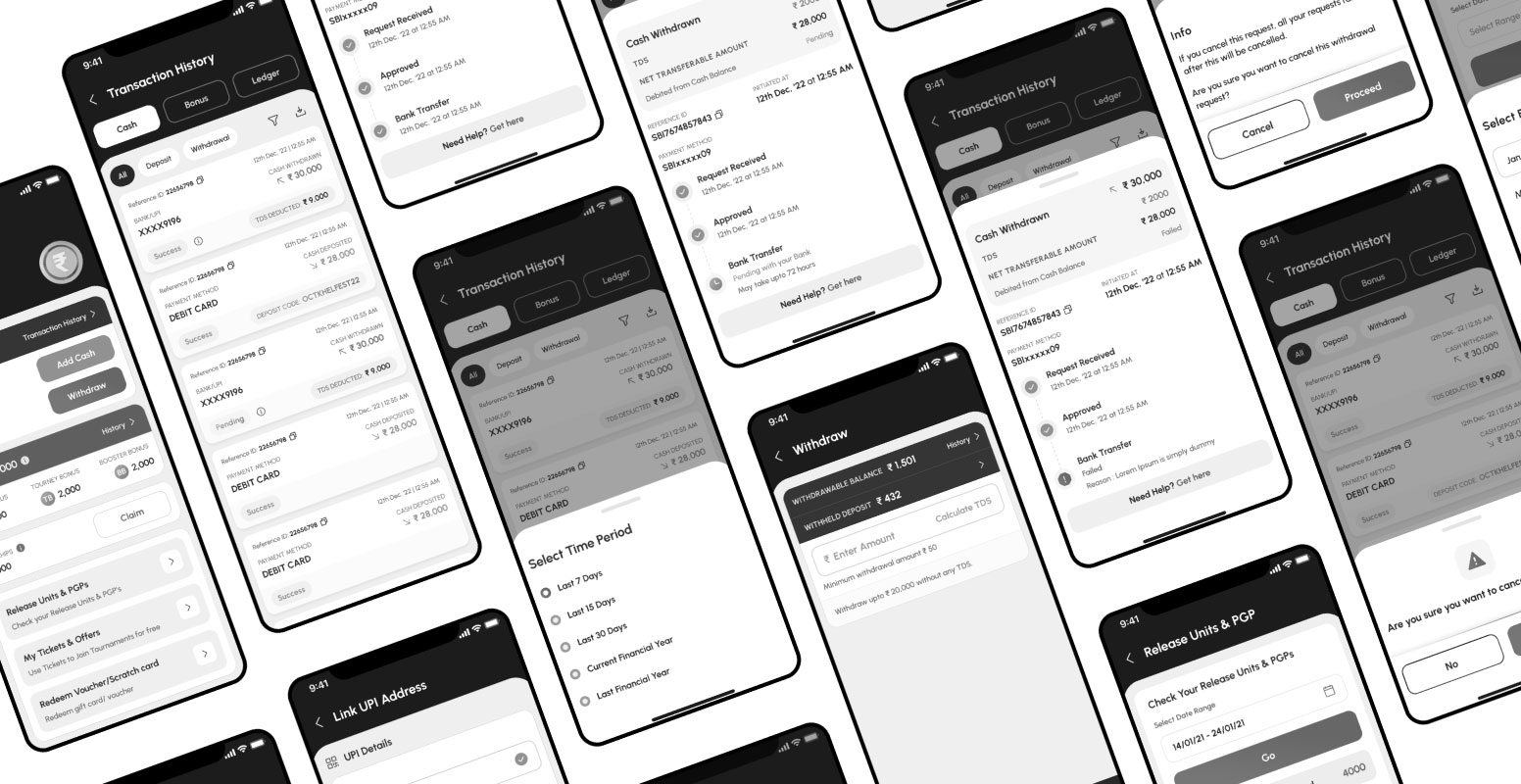

Withdrawals felt opaque — users did not clearly understand statutory deductions, leading to avoidable support requests.

Transaction history was hard to search and filter, making it difficult for users to find past transactions for disputes or records.

Primary goals:

Increase Add Cash conversion and average top-up value.

Reduce wallet-related support load by clarifying fees and taxes.

Improve transparency for withdrawals (TDS) so disputes fall.

Make transaction history fast and useful for users.

KPIs we tracked:

Add Cash conversion rate (primary)

Average top-up (AOV)

Wallet-related support tickets / month

Withdrawal success rate & TDS-related disputes

Time to locate a transaction in history

Estimated revenue impact

Quantitative:

Analyzed 10,432 wallet transactions and 1,200 support tickets.

Identified that 41% of failed top-ups were churned at the confirmation screen where taxes and fees were shown.

Qualitative

We interviewed 20 users, including a mix of high-activity and casual players, to understand their experience with wallet transactions. Many users expressed confusion around deductions and charges, with comments like, “I don’t know why ₹20 is missing — is that a fee or tax?” and “I had to contact support to know why my withdrawal was reduced.”

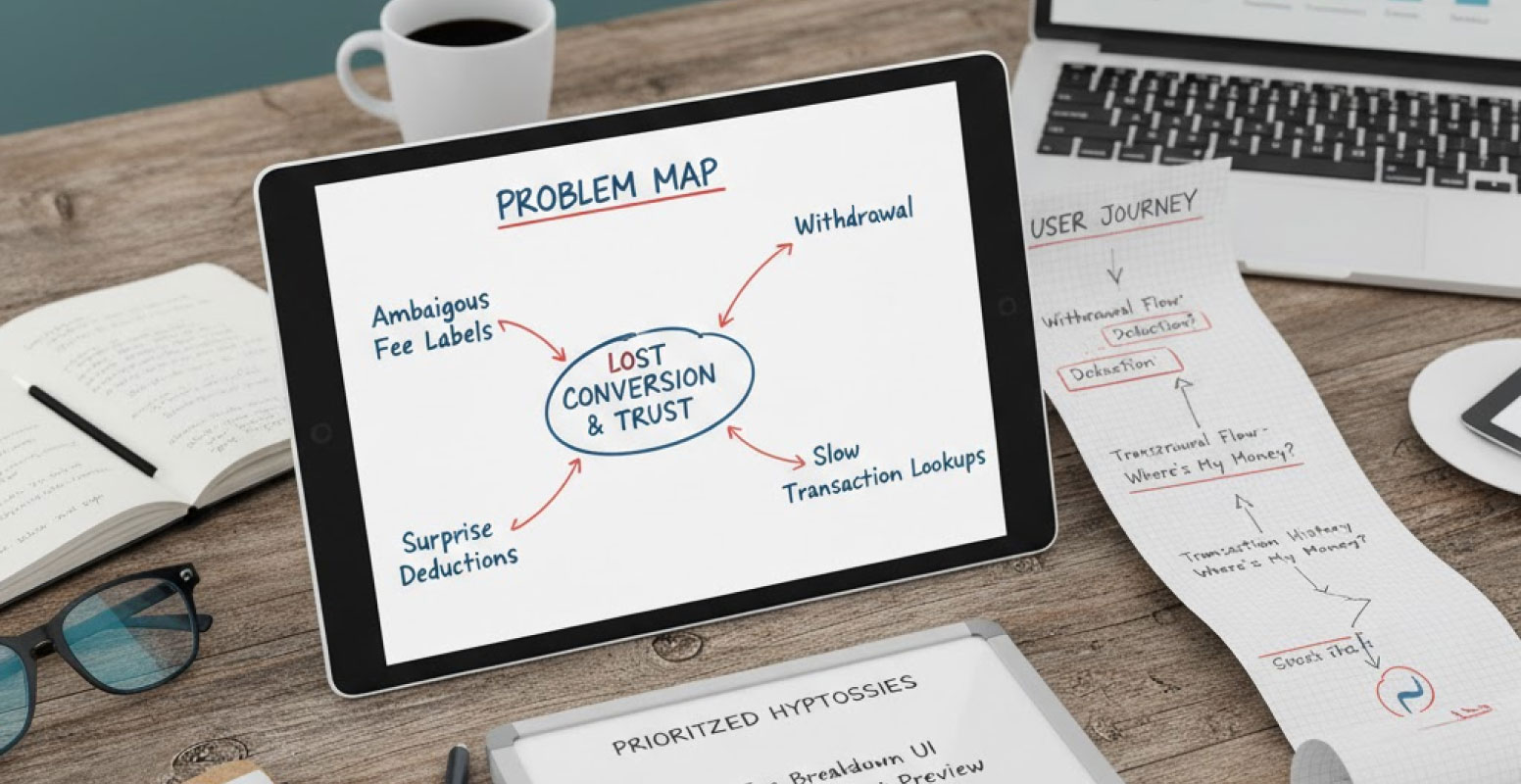

We began by listening — to users, support logs, and finance. Our discovery combined quantitative analysis of wallet events and failure points with qualitative interviews to uncover where users got confused. We prioritized problems that hurt both conversion and trust: ambiguous fee labels, surprise deductions during withdrawals, and slow transaction lookups. Early artifacts included a problem map, user journey with pain points highlighted, and a prioritized list of hypotheses to validate.